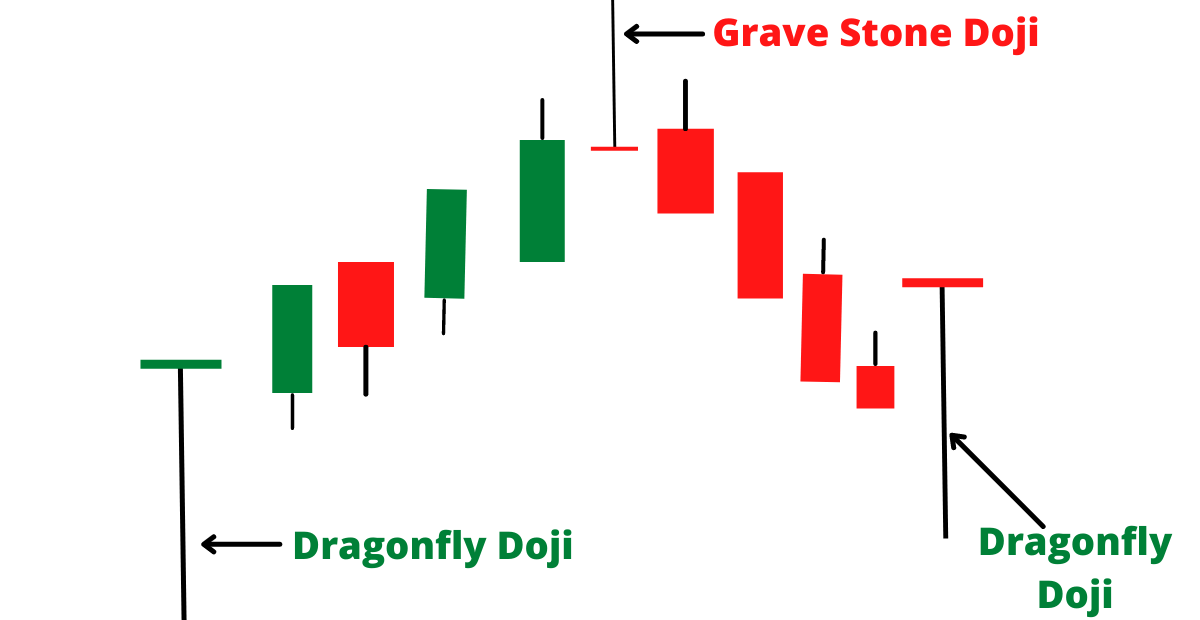

A dragonfly doji is a type of doji candlestick pattern that is characterized by a small body at the bottom of the chart with long wicks extending upward from both ends. The long upper wick indicates that the security’s price has risen significantly during the day, but ultimately ended up closing at or near the opening price. The small body at the bottom of the chart indicates that there was little price movement throughout the day.

Dragonfly doji candlesticks are generally seen as bullish patterns, indicating that buyers were able to push the price up significantly, but ultimately sellers were able to push the price back down to the opening level. This can be seen as a sign of strength or buying momentum, and may indicate that the security’s price is likely to continue to rise.

It is important to note that dragonfly doji candlesticks should not be interpreted in isolation, but rather in the context of the overall trend and other technical analysis tools and indicators. Technical analysis is just one approach to evaluating securities, and it is important to consider other factors such as fundamental analysis and market conditions when making investment decisions.

Leave a comment