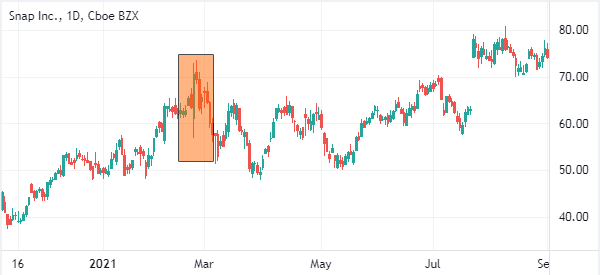

In technical analysis, a whipsaw is a rapid and unpredictable price movement that can occur in a volatile market. A whipsaw can occur when there is a sudden change in market conditions, such as a change in supply and demand or a sudden influx of new information.

Technical analysts may use various techniques to try to anticipate and prepare for a potential whipsaw, including:

-

Trend analysis: By identifying and following trends, technical analysts may be able to anticipate potential whipsaws and adjust their trading strategies accordingly.

-

Support and resistance analysis: By identifying key support and resistance levels, technical analysts may be able to anticipate potential whipsaws and set stop-loss orders to minimize potential losses.

-

Volume analysis: By analyzing volume data, technical analysts may be able to identify potential whipsaws and adjust their trading strategies accordingly.

-

Risk management: Technical analysts may use risk management techniques, such as setting stop-loss orders or using leverage responsibly, to minimize the impact of a potential whipsaw on their portfolio.

Whipsaws can be difficult to anticipate and can present challenges for technical analysts, but by using a combination of techniques and maintaining a well-thought-out trading plan, it is possible to navigate a volatile market successfully.

Leave a comment