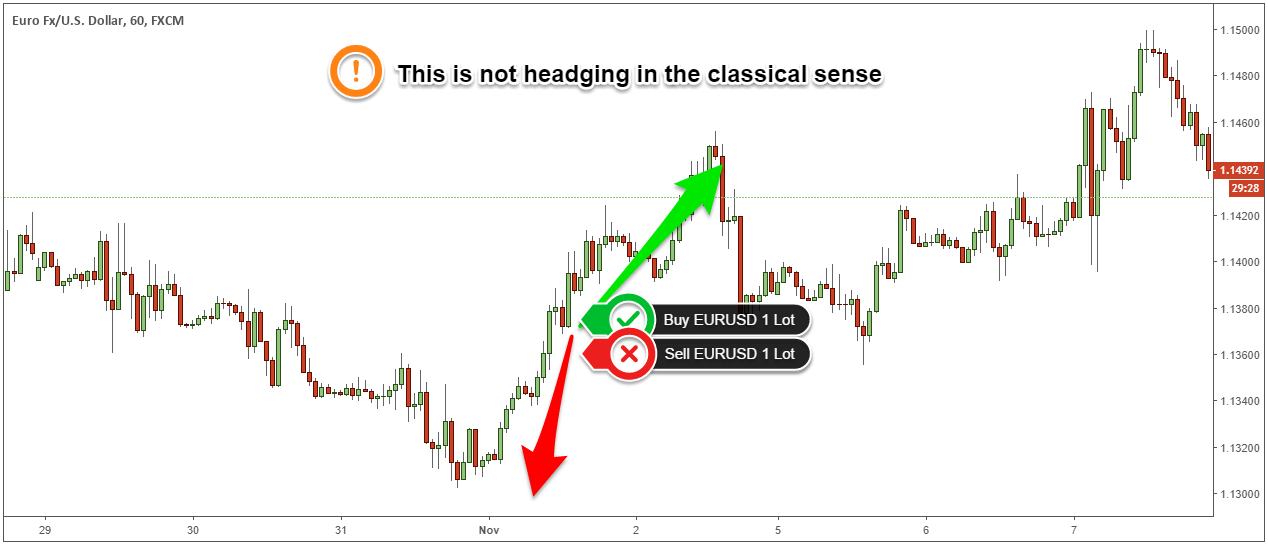

Hedging is a risk management strategy that involves taking offsetting positions in order to reduce the risk of loss from an investment. In the stock market, hedging can involve buying and selling different securities or derivatives, such as options or futures contracts, in order to protect against potential losses in the underlying stock.

For example, an investor who owns a stock may buy a put option on that stock as a hedge. If the stock price falls, the investor can exercise the put option to sell the stock at a predetermined price, which can offset some or all of the loss from the falling stock price.

Hedging can be used to manage risk in a portfolio, to protect against market fluctuations, or to reduce the impact of specific events, such as a company’s earnings announcement or a change in economic conditions. It is a common risk management technique that is used by investors and traders to mitigate the potential for loss.

Leave a comment